The key to financial success is understanding the relationship between the income statement and the balance sheet

What does it mean to be rich?

This is perhaps the most important question you can ask and answer. For most people, being rich means making a lot of money. They think that if they can just make a little more each month, all their problems will be fixed. They’ll live like kings and queens.

Living like kings and queens?

So, let me ask you this, would making $100,000 a year make you rich? My guess is that the average person making $59,000 a year would say yes. But like beauty, being rich is in the eye of the beholder.

NPR recently profiled the lives of people living on $100,000 a year. The article sheds some surprising light on the struggles these so-called rich people have. In most cases, the money is quickly eaten away by things like mortgages or rent, student loan debt, and family obligations. In most cases, the people are trying to keep up with the Joneses…but at quite a cost.

One mother, Theresa Sahhar, whose husband’s salary of $100,000 (equivalent to $250,000 in Manhattan cost of living) still works various odd jobs in the gig economy to put her son through a private high-school. She shares with NPR, “I was really surprised because from the outside, it looks like we have plenty of money. But then when you really look underneath it all, you see that people are working overtime. They’re working second jobs and even third jobs to try to put together the money just to stay in the middle class where they’ve been in the past.”

It would be tempting to say that these are just extreme examples…except they’re not. The reality is that $100,000 really doesn’t go that far—especially when you don’t have a robust financial education.

Where financial literacy begins

The reality is that money doesn’t make you rich. What does make you rich is your financial IQ. Give the same $100,000 to a person with a low financial IQ and a person with a high financial IQ and I guarantee you’ll see a vast difference in how that money is spent and grown.

Central to the difference between those with low and high financial IQs is a simple but profound literacy: the ability to understand a financial statement.

One of the most important things you need to know in order to be financially successful is to read an income statement and balance sheet.

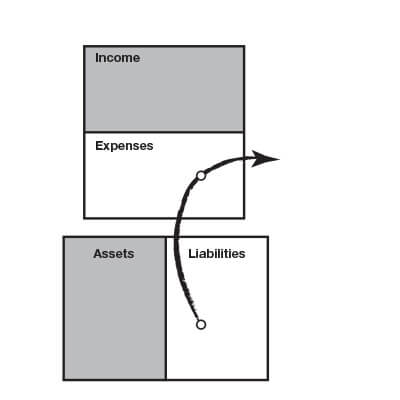

But even more important is understanding the relationship between them.

Many people learn in accounting classes how to read an income statement and balance sheet separately. I’ve always found it fascinating, however, that these classes don’t teach why one document is important to the other or how one affects the other.

My rich dad, however, felt that the relationship between the two was everything. “How can you understand one without the other? How can you tell what an asset or liability really is without the income column or the expense column?” he asked.

For rich dad, understanding the relationship between the two allowed you to easily see the direction of your cash flow to easily determine if something was making you money or not.

If something was making money, it was an asset. If not, it was a liability.

“Just because something is listed under the asset column does not make it an asset,” said rich dad. “The reason people suffer financially is that they purchase liabilities and list them under the asset column.”

The magic words are cash flow

It’s this simple insight that explains why those with a low financial IQ are still poor even when they make more than $100,000 a year. They don’t know how to move their money into assets that make them more money. Instead, they spend it all on liabilities and live large paycheck to large paycheck.

To rich dad, the most important words in business and investing were cash flow. He would say, “Just as a fisherman must watch the ebb and flow of the tides, an investor and businessperson must be keenly aware of the subtle shifts in cash flow. People and businesses struggle financially because they have poor control of their cash flow.”

KISS (Keep It Super Simple)

One of my rich dad’s greatest skills was to take complex things and make them super simple. It was one of his rules for investing—KISS, keep it super simple. He had a way of taking complex financial subjects and making them easy enough for even a nine-year-old boy to understand.

I know this because when I was nine, rich dad used the following simple diagrams to teach me the relationship between the income statement and the balance sheet. I still use them to this day.

If you can understand the following diagrams, you have a better chance of acquiring great wealth.

Cash flow patterns

An asset is something that puts money in your pocket. It’s that simple. This is the cash-flow pattern of an asset:

A liability is something that takes money out of your pocket. This is the cash-flow pattern of a liability:

Where it gets confusing

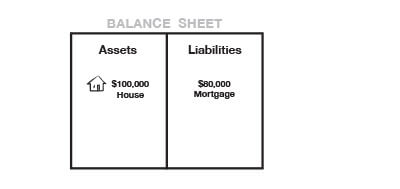

Rich dad pointed out that confusion happens for many because accepted methods of accounting allow for the listing of both assets and liabilities under the asset column.

To explain this, he again drew a simple diagram:

“This is why things get confusing,” rich dad would say. “In this diagram, we have a $100,000 house where someone has put $20,000 cash down and now has an $80,000 mortgage. How do you know if this house is an asset or a liability? Is the house an asset just because it is listed under the asset column?”

The answer is, of course, no. In order to know for sure, you would need to refer to the income statement to see if it was an asset or a liability.

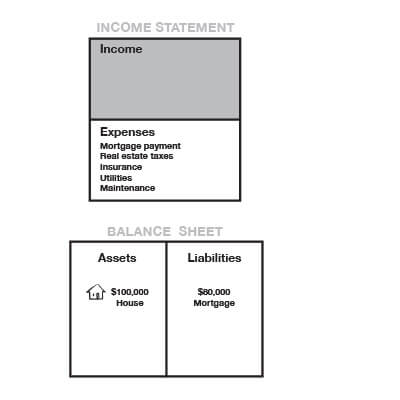

The house as a liability

To illustrate this, rich dad drew this diagram:

“This is a house that is a liability,” said rich dad. “You can tell it is a liability because it’s only line items are under the expense column. Nothing is in the income column.“

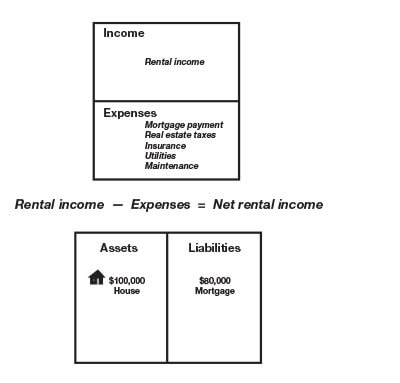

The house as an asset

Rich dad then added to the diagram a line that read “rental income” and “net rental income,” the key word being “net.” That addition to the financial statement changed that house from a liability to an asset.

Very simply, rich dad explained, if the rental income of the house, minus the expenses of the house, equaled positive net rental income, the house is an asset. If not, it is a liability.

These simple lessons are profound. And they are the basis for building all great wealth. Going back to my earlier comment, a person with a high financial IQ and $100,000 would be able to know how to invest it in assets that are true assets—ones that put more money back in the pocket each month. The person with the low financial IQ would spend that same money on liabilities, but wouldn’t be able to diagnose what was wrong. Instead, they would try and work harder to make more money—a vicious cycle we call the Rat Race.

Understanding the relationship between the income statement and the balance sheet allows you to quickly understand if an investment is an asset or a liability—and this understanding will allow you to make the right investment every time.

Think you understand how a financial statement works? Test your knowledge and Play CASHFLOW Classic for FREE.

Source: http://www.richdad.com/Resources/Rich-Dad-Financial-Education-Blog/December-2017/the-financial-statement-foundation-for-being-rich.aspx